What Is Errors and Omissions Coverage (E&O)?

Errors and omissions (E&O) insurance helps protect against the costs of allegations made by clients for inadequate work, negligent actions or failure to provide the expected level of service. As a professional operating in today’s increasingly litigious environment, you could easily be subject to allegations by unhappy clients who may feel they’ve been harmed by your actions or inactions. E&O insurance from Travelers can be customized to protect you and your company from the unique risks you face while working in your profession.

Who needs errors and omissions insurance?

For some professionals, contracts require E&O coverage in the event that a mistake, real or perceived, is made that costs your client money or damages their reputation. Even if you aren’t contractually required to carry E&O insurance, it’s a wise decision to help protect your business.

Without E&O insurance coverage, your business may be responsible for the costs of legal defense should you be sued. Those costs can include defense costs and settlement costs, as well as the time required to respond to a claim and the potential damage to your company’s brand and reputation.

Travelers knows errors and omissions insurance

Travelers understands that regardless of how well you plan, the potential for mistakes in the performance of a professional service is still very real. Your business's financial security can depend on how well protected you are from a lawsuit or claim. For that reason, Travelers E&O insurance offers protection for an array of emerging exposures and for losses resulting from negligence or errors and omissions in the performance of professional services.

Select a product

Accountants professional liability

Accounting professionals, including tax preparers and consultants, can be at risk for liability exposure in handling the sensitive financial information necessary to serve their clients.

Design professional liability

Design professionals, including architects, engineers, land surveyors, construction managers and consultants, can face allegations of mistakes from clients.

Lawyers professional liability

Legal professionals can be at risk for potential exposure due to administrative mistakes or substantive errors of law.

Miscellaneous professional liability

Miscellaneous professional liability insurance is designed to protect a wide variety of professionals who work with clients in providing products or services.

Professional liability for financial institutions

Financial institutions such as insurance agencies, banks, credit unions and investment firms — and their directors, officers and employees — can benefit from E&O policy coverage.

Real estate professional liability

Real estate professional liability insurance can help protect real estate professionals, including realtors, against the risks inherent in the course of working with buyers and sellers.

Related products & solutions

Insurance professionals errors and omissions

This E&O coverage is designed for the needs of insurance adjusters, investigators, inspectors and expert witnesses.

Life, accident and health insurance agents errors and omissions

This professional liability coverage is designed for life, accident and health insurance agents and brokers.

Managed care errors and omissions

Tailored coverages to address unique managed care exposures.

Uncover professional liability risks

(DESCRIPTION)

Text, Travelers. Umbrella logo. Errors and omissions liability coverage.

(SPEECH)

SPEAKER: Whatever your profession or the size of your business, you're accountable for the quality of your work. Whether you're a consultant, or a counselor, an accountant, or an architect, a lawyer, or a literary agent, your success depends on meeting your clients' expectations.

Are you aware that if a client thinks your work doesn't measure up, they can sue you? And fighting an expensive court case can cost you time, money, your reputation, customers, and possibly your whole business. Some clients won't hesitate to punish businesses for service they regard as negligent or below expectations.

And you can't always hide behind a strongly worded contract, since these are routinely challenged during trials. That's why you need to protect yourself with an errors and omissions policy. Because regardless of whether it was a large mistake or just a small oversight, you could face huge costs.

Consider-- a mailing services company hired a vendor to put together mailings and postage for five of its clients. However, the vendor took the fees, failed to send the mailings, and falsified UPS documentation. The losses to the client from this mail fraud exceeded $475,000, which the company had to pay back.

In another situation, a publisher sent a book to print with some pictures placed on the wrong pages. When the client received an advance copy and noticed the error, the entire book had to be reset and printed again. The damages for the delay to the client, as well as extra costs for the printer's additional work, cost the publisher in excess of $50,000.

Every day, you expose yourself to potential liability just by doing business. In fact, you could even be losing out on new business by not having errors and omissions coverage, as this coverage is required in many contracts. With risks like these and those yet to be discovered, you need an insurance company that can help protect and prepare you for what may coming your way.

That's why errors and omissions liability coverage isn't a maybe, but a must have. Talk to your independent agent to make sure you have the right coverage in place to help protect your business.

(DESCRIPTION)

Travelers Logo

Talk to your independent agent today. Travelers dot com

Travelers Casualty and Surety Company of America and its property casualty affiliates. One Tower Square, Hartford, CT 06183 This material does not amend, otherwise affect, the provisions of any insurance policy issued by Travelers. It is not a representation that coverage does or does not exist for any particular claim or loss under any such policy. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy provisions, and any applicable law.

MORE PREPARE & PREVENT

Insights to help you manage risks at work and on the road

Resources for Technology

4 Technology Errors and Omissions Insurance Risks

Get smart on technology E&O coverage with these four items for tech companies to look for in the coverage.

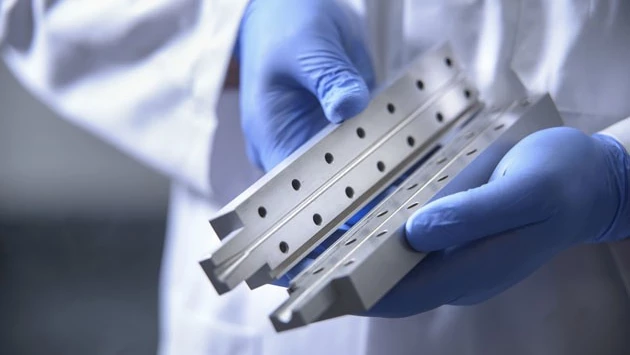

Manufacturing Resources

Manufacturers E&O Coverage

E&O can provide protection where general and product liability can't. Travelers provides manufacturers E&O coverage that can be customized to the unique risks faced by manufacturers.

Product and Services Liability Tips & Resources

5 Steps for Product Liability Risk Management

Help protect your business by creating a product liability protection program with these tips.

Applications and forms for agents

Access all management and professional liability applications, as well as the surety bond forms library.

2023 Travelers Risk Index: Cyber

The Travelers Risk Index provides an annual snapshot of risk viewpoints from over 1,200 business decision makers across the country.

Cyber Resources

Help protect your organization against cybersecurity risks by sharpening your cyber knowledge.

Are you managing your company from potential risks?

With a Travelers Professional Liability policy, you’ll have access to the latest Risk Management resources.