Financial Strength Ratings

Travelers is one of the largest providers of property and casualty insurance products in the United States. Our success is built upon our ability to provide innovative insurance and risk protection products and services in-synch with our customers' needs.

Summary of current ratings

The following is a summary of Travelers' ratings:

Claims-paying/financial strength ratings

Table displaying claims-paying/financial strength ratings:

Travelers Reinsurance Pool1

• A.M. Best: A++

• Fitch: AA

• Moody's: Aa2

• Standard & Poor's: AA

Source 1: The lead operating company in the pool is The Travelers Indemnity Company. A list of additional operating companies within the pool can be found in the company's 10-K and 10-Q filings with the SEC.

Travelers Casualty and Surety Co. of America

• A.M. Best: A++

• Fitch: AA

• Moody's: Aa2

• Standard & Poor's: AA

First Floridian Auto and Home Insurance Co.2

• A.M. Best: A-

• Fitch: AA

• Moody's: NA

• Standard & Poor's: NA

Source 2: First Floridian is a single-state subsidiary of The Travelers Indemnity Company.

Travelers Insurance Company of Canada

• A.M. Best: A+

• Fitch: NA

• Moody's: NA

• Standard & Poor's: AA-

The Dominion of Canada General Insurance Company

• A.M. Best: A-

• Fitch: NA

• Moody's: NA

• Standard & Poor's: NA

Travelers Insurance Company Ltd.

• A.M. Best: A++

• Fitch: NA

• Moody's: NA

• Standard & Poor's: AA

Travelers Insurance Designated Activity Company

• A.M. Best: A++

• Fitch: NA

• Moody's: NA

• Standard & Poor's: AA-

Notes: NA indicates that no rating is available.

All companies are rated separately on a statutory pool basis.

1 The lead operating company in the pool is The Travelers Indemnity Company. A list of additional operating companies within the pool can be found in the company's 10-K and 10-Q filings with the SEC.

2 First Floridian is a single-state subsidiary of The Travelers Indemnity Company.

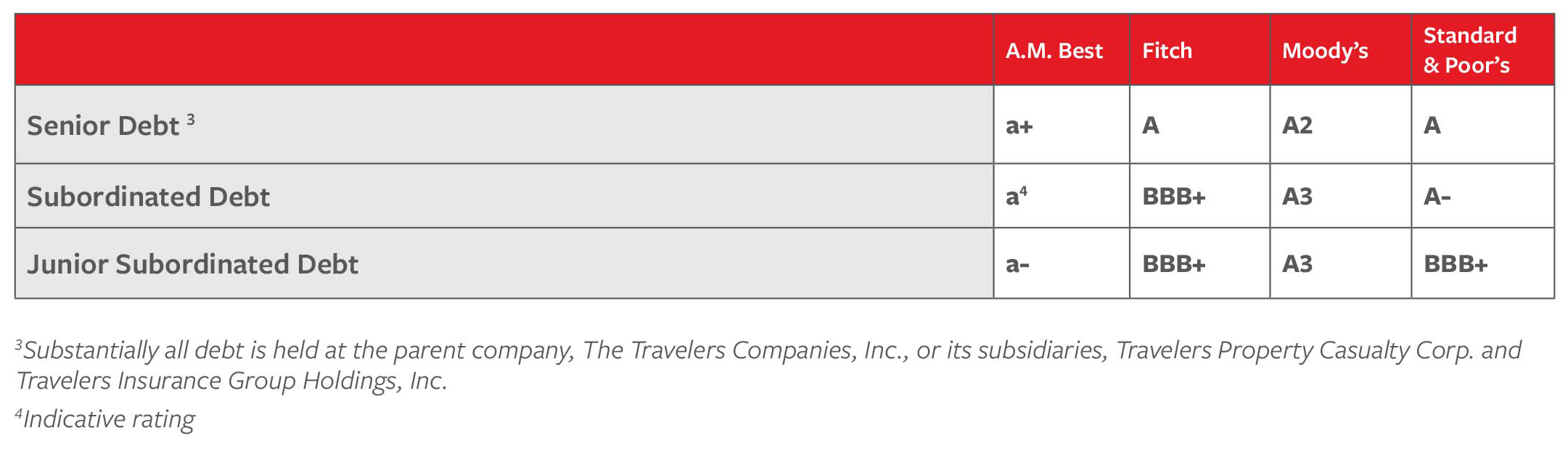

Senior debt ratings

Table displaying senior debt ratings:

Senior Debt3

- M. Best: a+

- Fitch: A

- Moody's: A2

- Standard & Poor’s: A

Source 3: Substantially all debt is held at the parent company, The Travelers Companies, Inc, or its subsidiaries, Travelers Property Casualty Corp. and Travelers Insurance Group Holdings, Inc.

Subordinated Debt

- M. Best: a4

- Fitch: BBB+

- Moody's: A3

- Standard & Poor's: A-

Source 4: Indicative rating

Junior Subordinated Debt

- M. Best: a-

- Fitch: BBB+

- Moody's: A3

- Standard & Poor's: BBB+

Short-term debt ratings

Table displaying short term debt ratings:

Commercial Paper

- M. Best: AMB1+

- Fitch: F-1

- Moody's: P-1

- Standard & Poor's: A-1

Background on ratings

Ratings agencies typically issue two types of ratings:

- Claims-paying and/or financial strength ratings assess an insurer's ability to meet its financial obligations to policyholders.

- Debt ratings assess a company's prospects for repaying its debts and assist lenders in setting interest rates and terms for a company's commercial paper, loans, bonds, etc.

The system and number rating categories can vary widely from agency to agency. Travelers' claims-paying/financial strength ratings relative to each agency's rating scale are as follows:

Table displaying Travelers claims-paying/financial strength ratings relative to each agency's rating scale:

A.M. Best

- A++ (Highest of 16)

- A (3rd highest of 16)

- A- (4th highest of 16)

Moody’s

- Aa2 (3rd highest of 21)

Fitch

- AA (3rd highest of 24)

S&P

- AA (3rd highest of 21)

- AA-(4th highest of 21)

Customers usually focus on claims-paying ratings, while creditors look at debt ratings. Investors use both to evaluate a company's overall financial strength. Travelers receives ratings from the major rating agencies:

- A.M. Best Co., Fitch Ratings, Moody's Investors Service and Standard & Poor's Corp.

Ratings factors considered

Ratings agencies examine a myriad of key factors:

- Quantitative financial performance – profit margins, financial leverage, liquidity, cash flows, capital and surplus ratios.

- Qualitative judgments – underwriting cycle, competitive environment, regulatory and political factors, soundness of reinsurance, reserves, quality of invested assets, management experience and accomplishments.

For additional information and the latest ratings, please see:

www.ambest.com

www.fitchratings.com

www.moodys.com

www.standardandpoors.com

Financial strength ratings information is provided to The Travelers Companies, Inc. via third-party resources. The Travelers Companies, Inc., its affiliates and its third-party licensors do not guarantee the accuracy, adequacy, completeness or availability of ratings information.