Why Do You Need Wedding Insurance?

The Wedding Protector Plan® from Travelers helps couples protect their special day, which can be a significant financial investment. Merely hoping, planning and dreaming may not suffice. A wedding insurance policy can help safeguard your special occasion.

45% of Travelers wedding claims in 2023 were due to vendor issues. 18% were due to property damage caused by wedding day accidents. Extreme catastrophic weather conditions, certain illnesses and injuries, and more account for the rest of the most common wedding insurance claims. Wedding insurance is important because as much as we hope and dream for a perfect wedding, things can go wrong, and you want to be protected.

YOUR BIG DAY DESERVES BIG PROTECTION

Are you sure you’re covered?

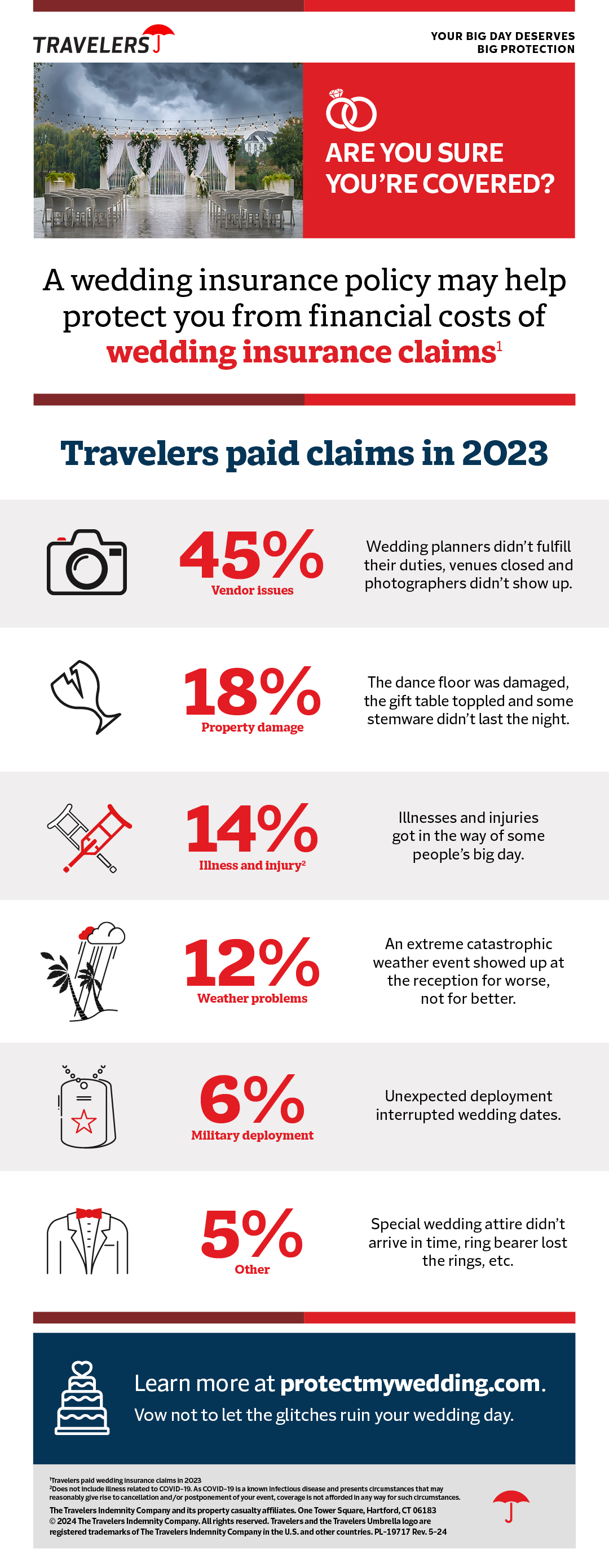

A wedding insurance policy may help protect you from the most common wedding insurance claims1

Travelers paid claims in 2023

45% Vendor issues

Wedding planners didn’t fulfill their duties, venues closed and photographers didn’t show up.

18% Property damage

The dance floor was damaged, the gift table toppled and some stemware didn't last the night.

14% Illness and injury2

Illnesses and injuries got in the way of some people’s big day.

12% Weather problems

An extreme catastrophic weather event showed up at the reception for worse and not for better.

6% Military deployment

Unexpected deployment interrupted wedding dates.

5% Other

Special wedding attire didn’t arrive in time, ring bearer lost the rings, etc.

Learn more at protectmywedding.com.

Vow not to let the glitches ruin your wedding day.

1Travelers paid wedding insurance claims in 2023

2Does not include illness related to COVID-19. As COVID-19 is a known infectious disease and presents circumstances that may reasonably give rise to cancellation and / or postponement of your event, coverage is not afforded in any way for such circumstances.

The Travelers Indemnity Company and its property casualty affiliates. One Tower Square, Hartford, CT 06183. © 2024 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. PL-19717 Rev. 5-24

As you embark on your wedding planning, it’s important to consider unplanned loss scenarios that could impact your wedding. Some of the most common claims Travelers saw in 2023 include:

- Vendor issues - 45%

- Property damage - 18%

- Illness/injury - 14%

- Weather - 12%

- Military deployment - 6%

- Other - 5%

Get a quote for wedding insurance from Travelers today.