Understanding the Three Parties in a Surety Contract

Businesses that have relationships with suppliers, vendors or subcontractors have a need for surety bonds.

A surety agreement defined

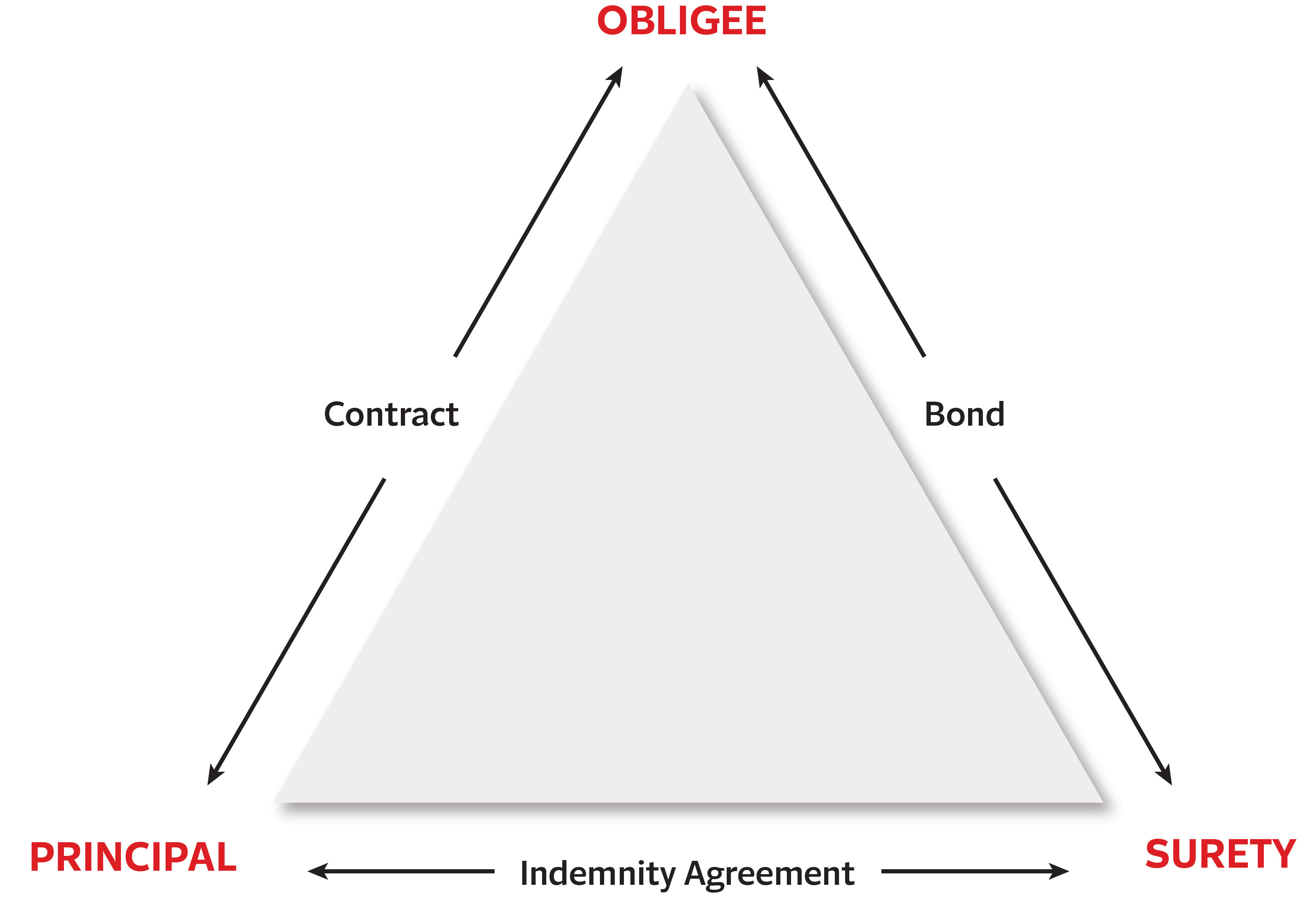

Surety bonds guarantee that one party will fulfill its bonded obligations to another party. They differ from an insurance contract in that an insurance contract includes two entities (insurance provider and policyholder), whereas a surety bond involves three parties: the Principal, the Obligee and the Surety.

With a surety bond, the Principal is guaranteeing payment or performance of its bonded obligation to the Obligee. The Surety, or bond issuer, assesses the Principal’s ability to fulfill its obligations as promised and agrees to compensate the Obligee for financial loss if the Principal does not deliver.

Consider the example of a general contractor working with a flooring subcontractor to understand how a surety bond ensures a bonded Principal’s performance:

- A general contractor (Obligee) needs a flooring subcontractor to install commercial carpet and tile in a new office building under construction.

- The flooring subcontractor (Principal) is expected to complete the job by a certain deadline.

- The insurer (Surety) guarantees the Principal’s performance after analyzing the Principal’s financial position, performance history and prior business relationships.

- If the Principal fails to fulfill its obligations as defined in the contract, the Obligee could incur additional costs or suffer losses from project delays or having to replace the subcontractor. A surety bond would cover these losses, either in part or in total. The surety has the right to seek reimbursement for its losses via the indemnity agreement executed by the Principal.

Equilateral triangle with text on each side and on each angle that illustrates the three parties involved in a surety bond and how they work with each other. Top angle reads Obligee. Bottom left angle reads Principle. Bottom right angle reads Surety. The text on each side of the triangle is sandwiched between outward arrows that point to the text labeling the connecting angles. Left side reads Contract that points to Obligee and Principal. Bottom side reads Indemnity Agreement and points to Principal and Surety. Right side reads Bond and points to Obligee and Surety.

Here’s a more detailed look at the three parties in a surety bond agreement:

The obligee

An Obligee is often a business owner, project owner or general contractor who needs assurances that a subcontractor, supplier or service provider will satisfy its obligations as defined in a contract. The Obligee is the party that requests the bond from the Principal and would be indemnified by the Surety if the Principal were not able to fulfill its contractual obligations. In the above contractor example, the general contractor (Obligee) is the party that could suffer financial and reputational harm if the flooring subcontractor (Principal) fails to complete its job.

The principal

The Principal is the entity that either provides goods or services, or manages or oversees projects for a customer. Within the context of the contractor example above, the flooring subcontractor would be the Principal because it is the party that is required to provide a guarantee to the Obligee and whose performance is guaranteed by the Surety.

The Principal, in turn, applies to the Surety for a bond that will guarantee timely delivery and performance on the Principal’s part. Before issuing this type of performance bond, the Surety conducts its due diligence on the Principal by examining its financial records, business references, track record and reputation, among other factors.

If the Principal does not perform the services contracted for and a claim is filed by the Obligee, the Obligee can use claim payments from the Surety to complete performance of the work in accordance with the contract’s specifications.

The surety

The Surety is the entity that issues the bond. The Surety’s initial step in the bonding process is to have a deep understanding of the Principal’s business from various perspectives. In this way, the Surety makes a prudent determination as to the Principal’s ability to successfully perform its duties and obligations under the contract.

The Surety typically maintains a team with expertise in each industry for which it issues bonds. Because of this specialized knowledge, the Surety is able to quickly assess the performance risk and prequalify the Principal.

Businesses that seek surety bonds often look to Sureties that have a local presence in their markets. This allows the Surety and bond applicant (Principal) to develop a long-term business relationship.

Making the right choice for surety contracts

Travelers can help meet the needs of companies looking for a surety provider. With the highest financial rating of A++ from A.M. Best, a 165-year history of protecting businesses and a reach that extends globally, Travelers is a model surety partner. Contact your independent agent today to find out more about obtaining a surety bond with Travelers.