The Impact of Driving Speed on Safety and Insurance Rates

When you’re in a rush, driving fast might be tempting and, for some, even provide a thrill. But driving at high speeds can lead to severe consequences, including accidents, steep legal penalties and higher insurance rates. Safety should always take priority over punctuality, and by understanding how driving speed, safety and insurance rates are connected, you will be better equipped to make safe choices on the road and potentially even save some money.

Exploring some key risks of speeding

The risk of speeding isn’t just about breaking the law; it’s a behavior that can have multiple serious implications. The National Highway Traffic Safety Administration (NHTSA) reports that in 2022 speeding factored into nearly 30% of fatal crashes, underscoring the compounding dangers it poses.1 For example, driving too fast can reduce your ability to react effectively and increase the space needed to stop safely, turning everyday drives into potential crashes.

The physics of speed: stopping distance

Understanding the physics of speed can help you better understand the dangers it poses. As speed increases, crash energy multiplies. For example, accelerating from 40 mph to 60 mph raises crash energy by 125%.2 Stopping distances also increase – at 55 mph, you need about 345 feet to stop your vehicle; at 70 mph, it takes approximately 490 feet.3 And this is in ideal conditions; more space is needed in rain, snow and ice.

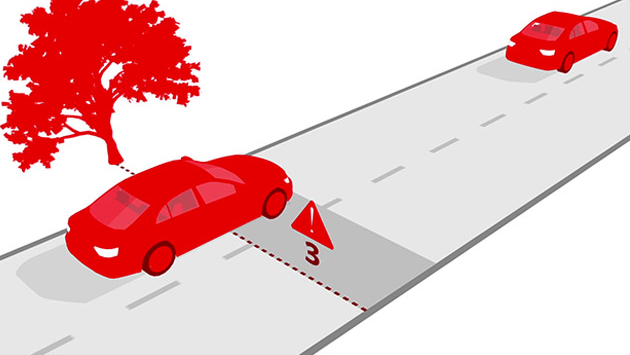

The distance required to stop safely also depends on the driver’s physical and mental condition, the car’s abilities, and road and traffic conditions. To help enhance safety, the National Safety Council (NSC) recommends using the three-second rule for maintaining a safe distance from the vehicle ahead.4 Pick a marker and count the seconds until you reach it. If it’s less than three seconds, slow down to allow for a proper following distance. Additionally, if the car ahead of you is speeding, you should resist the urge to match its speed to keep up, as maintaining a safe speed and following distance is important to ensure that you have adequate time to react to any potential hazards.

The financial and emotional costs of speeding

Driving over the speed limit can have far-reaching consequences beyond receiving a speeding ticket. Incidents resulting from speeding can carry extensive financial and emotional repercussions that can profoundly affect individuals and communities. Speeding incidents can lead to devastating crashes that impact individuals and communities both financially and emotionally. From strained emergency resources to prolonged trauma faced by victims, the stakes of speeding are high. It’s important to adopt safer driving practices to help mitigate these repercussions.

Financial consequences

The financial costs of speeding can add up quickly. Crashes can result in significant medical bills and vehicle repair costs. In addition, liability claims can result in substantial costs, particularly when extensive damage is involved. For example, the average economic cost of a motor vehicle accident involving disabling injuries reached $167,000 in 2023, according to the NSC.5 Beyond immediate expenses, the financial impact can persist, affecting quality of life and potentially exceeding $1 million for a victim of a disabling accident.6

Emotional and psychological impact

According to the NHTSA, high speeds are a significant contributing factor in traffic-related fatalities and injuries. In 2022, speeding-related crashes led to 12,151 fatalities, accounting for 29% of all traffic fatalities, and approximately 300,595 injuries.7 Beyond these statistics, victims may face mental health challenges like PTSD and depression. Families and survivors may endure grief and the struggles of life-altering injuries, affecting daily living and income potential and leaving lasting scars on communities.

The link between speeding and insurance rates

Driving fast can be considered a risky driving behavior, and it has a direct correlation to auto insurance rates. Insurers’ premium rates are based on risk. The higher the risk, the higher the insurance rate. Speeding is considered a risky driving behavior, so a history of speeding violations could be a red flag to an auto insurer. One with that history might expect to pay a higher rate for coverage.

How speeding violations affect premiums

Your car insurance rates will likely jump after a speeding ticket hits your record, but the exact impact varies based on the insurance company. Most insurers raise premiums for at least three years following such an infraction.8 Driving within the posted speed limit is essential if you want to maintain a safe driving record and help keep your premiums lower.

Statistical correlation between speeding and claims costs

Data shows a strong correlation between speeding and traffic accidents that lead to insurance claims. Speeding not only increases the chances of a crash but also the severity, leading to more costly vehicle damage, more severe injuries and a higher chance of traffic deaths.9 Given the increased likelihood of accidents, it’s no surprise that insurance companies consider drivers with a history of speeding as higher-risk clients, often leading to elevated premium rates.

Long-term impact on insurance costs

Repeat speeding violations can lead to a sustained increase in insurance premiums, lasting for years beyond the most recent infraction. If their current insurer declines to renew their policy, habitual speeders may have to find coverage with an insurer that accepts higher-risk drivers, typically at a greater expense. This continuous financial strain can be a wake-up call for drivers to recognize the ramifications of speeding.

The role of telematics in promoting safe driving

Telematics programs, such as Travelers’ IntelliDrive®, provide insurers the capability to measure driving behaviors such as speed, hard braking and distraction. Telematics programs utilize a compact device attached to the car windshield or a smartphone app to capture driving habits in real time. Telematics can supply feedback and suggestions aimed at helping drivers understand ways to enhance their skills and reduce their auto insurance costs by promoting safer driving practices. However, it’s important to be aware that riskier driving behaviors can lead to higher premiums.

By monitoring speed and offering safer driving tips and insights, telematics programs actively encourage safer driving behaviors. With some programs, drivers can receive alerts when they exceed speed limits, allowing them to slow down immediately, potentially avoiding a speeding ticket or a speed-related crash.

Impact of telematics on insurance premiums

Insurance companies are increasingly offering telematics programs. Drivers who use telematics may be eligible for savings based on their driving habits. This can help to significantly reduce insurance costs over time.

Driving at safe speeds is critical in helping to avoid crashes, tickets and higher insurance premiums. Consider using a telematics program that can help you become a safer driver and reward your efforts with potential savings.

Contact your local independent agent or a Travelers representative to learn more about the IntelliDrive programs, Travelers’ telematics programs that can measure driving behaviors such as speed, braking and distraction.

Sources

1 https://crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/813643

2 https://www.iihs.org/topics/speed

3, 4 https://www.nsc.org/getmedia/a46d07cb-faf1-4572-8317-661e7f77ef7a/instructor-admin-reference-guide.pdf

5, 6 https://injuryfacts.nsc.org/all-injuries/costs/guide-to-calculating-costs/data-details/

7 https://crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/813582.pdf

8 https://www.iii.org/article/if-i-file-claim-will-my-premium-go

9 https://www.nhtsa.gov/book/countermeasures-that-work/speeding-and-speed-management/understanding-problem