Weather Resources

Weather preparedness and response

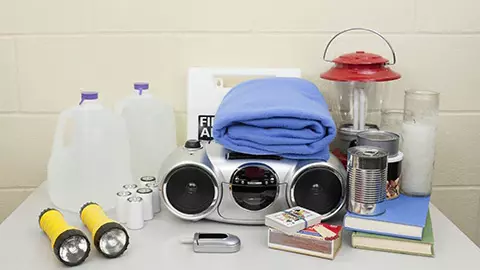

Be ready before and after severe weather strikes.

Emergency preparedness

Discover more

5 Steps to Create a Home Inventory Checklist

8 Disaster Preparedness Tips

Hurricanes

Hurricane Protection and Response Resources

Returning to Your Property After a Hurricane

Help stay safe when returning to your home after a hurricane. Get tips from Travelers to help you understand what to do after a hurricane hits your home.

Hurricane Protection and Response Resources

Hurricane Preparedness for Businesses

If your business is in the projected path of a hurricane, you need to act fast. Consult this checklist for preparation guidance.

Hurricane Protection and Response Resources

Hurricane Survival Guide: Things to Do During and After the Storm

Being caught in the path of a hurricane can be scary. Know what to do during and after a hurricane with information from Travelers.

Tornadoes

How to Help Prepare for Tornadoes

Tornado Safety at Home

What to Do During a Tornado

Earthquakes

Earthquake Safety Resources

Earthquake Facts and Myths

Believing common earthquake myths can put you at risk. Learn about earthquake facts and myths and how to help prepare for an earthquake.

Earthquake Safety Resources

Earthquake Facts and Safety Tips

Earthquakes are unpredictable and can happen any time of year. Get earthquake survival tips and facts with this earthquake infographic from Travelers.

Earthquake Safety Resources

Earthquake Safety and Preparedness

Do you know what to do during an earthquake, or how to prepare before one happens? Read these tips that can help you stay safe before, during and after an earthquake.

Winter storms

Discover more

How to Help Prepare for a Snowstorm

How to Help Prevent Ice Dams

Wildfires

Wildfires

Air Quality Health Concerns Related to Wildfire Smoke

Here are some steps to help protect employees from poor air quality due to chemicals, gases and fine particles contained in smoke and ash from wildfires.

Wildfires

How to Help Prepare for a Wildfire

Learn how to prepare for a wildfire, including tips for before the fire starts, and as it approaches and passes. Get wildfire safety tips from Travelers.

Wildfires

Using Technology to Help Homeowners Begin to Rebuild After a Property Loss

Most homeowners know how fickle Mother Nature can be. From hurricanes and hailstorms to wildfires, sometimes there's little you can do to avoid the risk of property damage and loss.

Thunderstorms

Thunderstorm Safety Tips

Severe Convective Storms: A Preparedness Guide for Business Resilience

Understand the risks severe storms pose to business owners with this comprehensive guide. Travelers offers insight to help protect your employees and property.

Thunderstorm Safety Tips

Lightning Safety Tips

Lightning safety precautions can help you to stay safe in a lightning storm. Get lightning safety tips from Travelers.

Thunderstorm Safety Tips

Lightning Safety Outdoors

During a lightning storm, it is best to seek shelter. But if you are stuck outside, follow these tips for lightning safety outdoors from Travelers.

More weather

Flood Protection Resources

4 Ways to Help Protect Your Home from Flooding

Do you know how to help protect your home from flooding? Get tips from Travelers to help you prepare your home in the event of a flood.

Flood Protection Resources

Flood Damage Prevention

Looking for information on how to help protect your property from flood damage? These tips can help you protect your home before, during and after a flood.

Hail Protection Resources

Hail Protection for Your Home

Following these tips for hail protection can help minimize damage to your home and car caused by hailstorms. Learn about minimizing hail damage.

Hail Protection Resources

Identifying Hail Damage to Your Roof

Do you know how to identify hail damage to your roof? Learn the signs of hail damage and what to do if you believe your home sustained hail damage.

Resources from the Travelers Institute®

Live from the CAT Center: Where Expertise Meets Innovation

In this webinar, we went to the Travelers National Catastrophe Center to learn how we monitor weather in real time, assess damage quickly and ensure we deliver on our promise to our customers.

Helping Communities Prepare for the Unexpected

The Travelers Institute’s disaster preparedness initiative raises awareness about the risks from natural disasters and how communities can respond and recover.